What if carbon removal was priced by how long it lasts?

The promise and the peril of Ton-Year Accounting

I’m on record complaining that carbon dioxide removal pricing makes no sense. A ton of CO2 captured by planting trees costs something like $30, but that same ton captured with a fancy Direct Air Capture (DAC) plant will set you back a thousand bucks.

That seems crazy. But is it?

As several of you wrote in to say, it’s only crazy if you ignore the time dimension.

The forest will probably end up getting logged or burning down within 30 years, then the carbon goes right back out into the air. The carbon the DAC plant captures, by contrast, will stay captured for a thousand years. Look at it temporally and the apparent cost differential disappears: either way, you’ll pay about $1 to keep one ton of CO2 out of the air for one year.

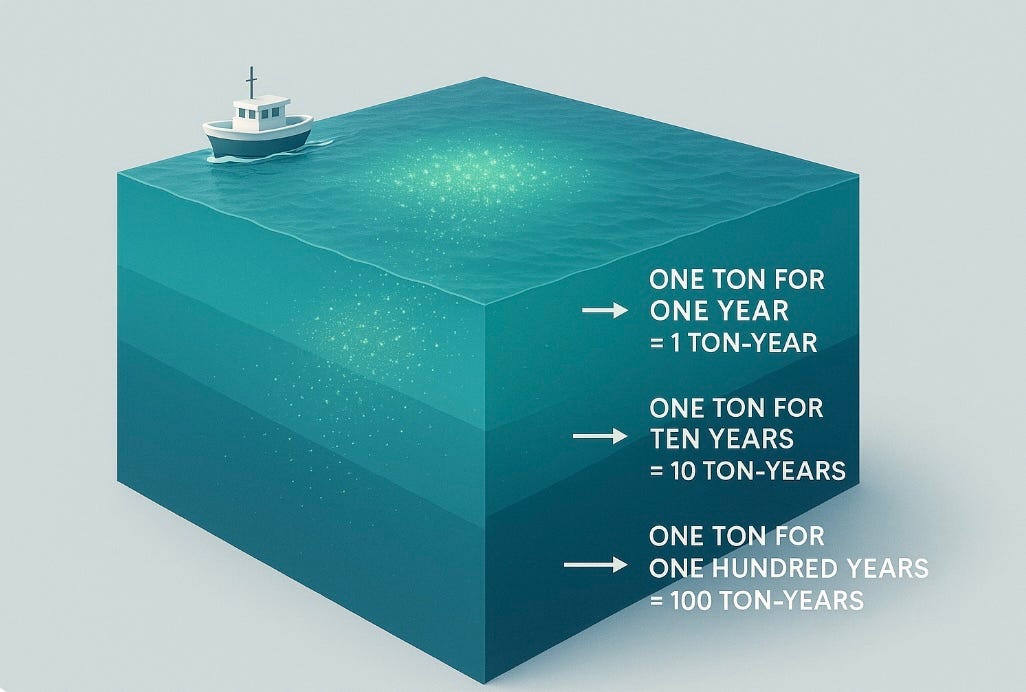

That’s the basic idea behind Ton-Year Accounting (TYA), admittedly one of the nerdier climate rabbit holes you can fall down. Ton-Year Accounting would make the price of carbon capture proportional to how long the carbon stays out of the air. Using ton-years as the unit of account, TYA allows us to make direct comparisons across very different CDR techniques.

This, or something like it, is something we sorely need.

I’m an ocean photosynthesis guy. For me, the case for TYA is especially compelling.

When you fertilize a patch of ocean, you trigger a phytoplankton bloom that draws down CO2 , but not all of that CO2 stays in the ocean for the same period of time. Some of the plankton gets eaten, and then the carbon it captured is released again pretty quickly. The rest of it sinks. The farther down it sinks, the longer the carbon stays out of the air.

Measuring exactly how much carbon reaches what depth under different conditions is one of the hard-core challenges in ocean fertilization. Pricing it is no easier.

TYA could cut through the haze.

Under ton-year accounting, an ocean fertilization project would be able to price each ton of CO2 sequestration by how far it’s made it down the water column, because depth correlates directly with how long it’s likely to stay out of the air.

A ton that sinks down to 10-year depth would then earn you 10 ton-years. Another one that makes it all the way down to 100-year sequestration depth would trigger a credit worth, you guessed it, 100 ton-years.

You’d have to do an awful lot of sampling and quite a lot of math, but in the end you’d get one number. A number of ton-years. A standardized, fungible commodity that trades at a single price.

The beauty of TYA for ocean fertilization is the way it would align incentives. Ton-year accounting would give ocean fertilizers a clear incentive to optimize for export to depth, while still generating some cash flow from carbon that doesn’t get stored for very long.

This makes intuitive sense — it wouldn’t be simple, but it would be right.

Does this mean there are no drawbacks to TYA? Alas no. There are a number of complications. The biggest, I think, has to do with discounting.

For one, it’s obviously not true that one ton of CO2 kept out of the air this year is worth the same to us as a ton kept out of the air a hundred years from now. We naturally care more about the near future than we care about the far future. Tons taken out of the air now are especially valuable for exactly the same reason that a dollar in your pocket right now is worth more to you than a dollar in your pocket a year from now.

The good news is that we have a very well developed set of techniques to price relative value across time: it’s called finance. The math, at least, is not mysterious.

Still, the details are tricky.

How aggressively do we want to discount the future? Do we want to say a ton-year one year in the future is worth 5% less than a ton-year this year? Or is it 3%? Or 20%?

There’s no technically correct way to answer that question. There’s no Federal Reserve Bank of Climate to set a global discount rate for carbon. Any proposed answer amounts to value judgment.

Which suggests things could get messy.

At worst, you can imagine a market where different issuing bodies use different discount rates for different credits.

DAC providers, for example, would surely push for a low discount rate, maximizing the current value of their long-duration storage. Foresters would push for a higher discount rate, making their short-duration ton-years look cheaper by comparison. The result? Probably more fragmentation, with long-duration credits clustering in low-discount-rate markets and short-duration ones in higher-discount-rate markets.

Badly deployed, TYA could leave you with a situation just as confusing as today’s chaotic carbon market.

So no, it’s not a magic bullet. TYA could bring some order and coherence to a sector badly in need of both, but at the cost of making an already arcane market even more impenetrable to normal people.

Choosing a discount rate seems to me like the biggest problem. You’d have to pick one, even if you end up picking zero. Your choice would then have a huge impact on the financial viability of any given carbon removal project. There will be winners, and there will be losers. And there’s no getting around the fact that this choice will always be, at some level, arbitrary.

Still, markets need a standardized thing to price if they’re going to do the thing that markets do best: seek efficiencies.

And ton-years could be that thing, in a way that plain old tons obviously can’t be.

Imagine a future when traders can sell off expensive ton-years from DAC projects and use the proceeds to buy up cheaper ton-years from forestry projects. That would lower the price of DAC ton-years and raise the price of forestry ton-years, until the two converge. That’s the law of one price at work.

If at the lower ton-year price that DAC project doesn’t pencil out, it’ll end up shutting down. That’s market guiding our scarce CDR resources towards the most efficient use — in this case, planting trees. If, next year, a new DAC technology emerges and undercuts the cost of forestry ton-years, then the tree projects would have to adapt or go out of business. That’s creative destruction, put to work on behalf of the climate.

As an ocean photosynthesis guy, I’d like to see these market forces unleashed. I’m convinced there’s no cheaper ton-year out there than an ocean photosynthesis ton-year. Build a market that rewards efficiency, and ocean fertilization would end up with most of it.

Of course, I could be wrong. Some other technique — BECCS? Biochar? something nobody’s invented yet? — could develop a decisive cost advantage under TYA. If that happens, capital will flow from less efficient techniques to that new, superior approach. The result would be less waste, and more climate repair.

And that’s what we all want, isn’t it?

I'm all for this, BUT if we're going to restructure the whole carbon market, maybe we could design in some liquidity? What if we treated long-duration removals like a yield-bearing asset instead of a one-off expense? What would a liquid market for ‘permanence-premium’ CO₂ look like—something that appreciates (or at least prices) over time the way a bond or a futures strip does? Maybe this would shift carbon from a cost to an investible asset that might make money the better we get at it.

We wanted to do this at Nori, where we would guarantee 10 years per NRT (our carbon tonne unit, "Nori Removal Tonne") for soil carbon, and would say if you want 100 years of permanance, then buy 10 NRTs today. Eventually the pushback was too strong from the crowd who were (with valid evidence and arguments) saying that if you are going to offset 1 tonne of fossil emissions today, that 1 tonne of CO2 will have a forcing effect for 1000 years, and therefore you should offset with like for like only. And then the John Oliver bit about NCX came out, and that pretty much killed the concept among the carbonati. But I still think it's a valid approach.